June 24, 2007

A Real-Time Message FIFO

Real-time messages often appear on your screen only for the duration of a single chart-refresh interval and disappear before you have time to read them. The FIFO (First In First Out) n-line display presented here captures and scrolls messages in the chart Title so that they are easier to read. Logging messages to DebugView or the Interpretation window would require opening additional windows. Using the Title instead displays the messages right on the chart and is more space-efficient.

A typical application would be to display real-time system status, such as order status, TWS error messages, partial fills, account balance, profits, etc.

Since the chart Title does not support formatting, it is advisable to use a mono-spaced font, such as Lucida Console, and pad spaces to create columns. The integer part of the NumToStr() formatting parameter sets the overall length of the returned string and can be used to format columns. If you prefer more font and color options, you can use Gfx functions to display the messages.

To prevent Title wrapping, you can truncate messages using the StrLeft() function. This works well for TWS error messages that can be long but carry the important info at the left of the error message. The demo below uses a simple PadString() function to space short messages in columns.

The AddToFIFOTitle() function is called whenever you want to add a message to the table. Its first argument is the name of the static variable that contains the table, the second argument is the message you want to add to the table, and the third is the maximum number of lines in the table. Setting the third argument to zero clears the table.

To keep things simple, the code below uses Param functions to simulate real-time messages; in a real system, these messages would be generated by real-time events. To test the code, click any of the numbered Event Messages in the Parameter window.

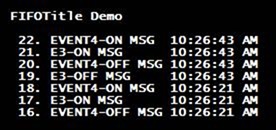

The Title produced should look like this:

Note that messages in this example are padded to position the next column properly. The order of the messages is inverted to allow the last message to appear at the top of the message table. Whenever the maximum number of lines is exceeded, the oldest message is removed. To ensure that the table is updated at least once a second you should always include a RequestTimedRefresh(1) in your code.

Finally, in Automated Trading you don’t always need charts, and you may prefer to display only a status table. Since the table is stored in a global Static Variable, you can read the table from any pane or window using just two lines of code:

RequestTimedRefresh( 1 ); Title = "\n"+StaticVarGetText("FIFOTitle");

If you use several scrolling displays in different panes, you should key the Static Variables as explained in Keying Static Variables. The complete demo code follows:

function padString( String, ColWidth ) { SpaceFill = " "; if( String == "{EMPTY}" ) String = ""; SL = StrLen(String); NS = StrLeft(SpaceFill, ColWidth-SL); return string+NS; } function AddToFIFOTitle( StrName, Str, MaxItems ) { // Add New item NewString = ""; PrevStr = StaticVarGetText( StrName ); ItemCount = Nz(StaticVarGet("NumberItems")); if( MaxItems == 0 ) { StaticVarSetText(StrName, ""); StaticVarSet("NumberItems",0); S1 = ""; } else if( Str != "" ) { StaticVarSet("NumberItems",++ItemCount); NewTitle = NumToStr(ItemCount,3.0,False)+". "+Str + "\n"+ PrevStr; for(s=0, n=0, S1=""; ( s2=StrMid(NewTitle,s,1) ) != "" AND n < MaxItems; s++ ) { S1 = S1 + S2; if( S2=="\n" ) n++; } } else S1 = PrevStr; // come here when Str == "" StaticVarSetText(StrName, S1); return StaticVarGetText(StrName); } RequestTimedRefresh( 1 ); // Simulate Transient (Trigger) Events Event1 = ParamTrigger("Event Message 1", "EVENT1"); Event2 = ParamTrigger("Event Message 2", "EVENT2"); // Simulate State events and convert to triggers PrevEvent3 = Nz(StaticVarGet("Event3") ); Event3 = ParamToggle("Event Message 3", "EVENT3OFF|EVENT3ON",0); StaticVarSet("Event3",Event3); Event3Trigger = Event3 != PrevEvent3; PrevEvent4 = Nz(StaticVarGet("Event4") ); Event4 = ParamToggle("Event Message 4", "EVENT4OFF|EVENT4ON",0); StaticVarSet("Event4",Event4); Event4Trigger = Event4 != PrevEvent4 ; MaxEvents = Param("Max. Number Events",5,0,20,1); if( Event1 ) { Msg1 = PadString( "EVENT1 MSG", 15)+Now(2); AddToFIFOTitle( "FIFOTitle", MSG1, MaxEvents ); } if( Event2 ) { Msg2 = PadString( "EVENT2 MSG", 15)+Now(2); AddToFIFOTitle( "FIFOTitle", Msg2, MaxEvents ); } if( Event3Trigger ) { Msg3 = PadString( WriteIf(Event3,"E3-ON MSG","E3-OFF MSG"), 15)+Now(2); AddToFIFOTitle( "FIFOTitle", Msg3, MaxEvents ); } if( Event4Trigger ) { Msg4 = PadString(WriteIf(Event4,"EVENT4-ON MSG","EVENT4-OFF MSG"), 15)+Now(2); AddToFIFOTitle( "FIFOTitle", Msg4, MaxEvents ); } Title = "\nFIFOTitle Demo\n\n"+AddToFIFOTitle( "FIFOTitle", "", MaxEvents);

Edited by Al Venosa

Filed by Herman at 2:59 pm under Real-Time AFL Programming

Filed by Herman at 2:59 pm under Real-Time AFL Programming

Comments Off on A Real-Time Message FIFO

6 Comments

6 Comments